Financial and Other Disclosures

Financial Targets: Actuals Compared to Budget

The following table provides a comparison of the financial targets and outcomes against criteria included in the Resource Agreement between the Commissioner of Main Roads, Minister for Transport and the Treasurer.

| 2017-18 Target(1) $000 |

2017-18 Actual $000 |

Variation(2) $000 |

|

| Total cost of services (expense limit) | 1,274,384 | 1,263,570 | (10,814) |

| Net cost of services | (58,247) | 167,376 | 225,622(a) |

| Total equity | 50,798,886 | 47,120,450 | (3,678,436)(b) |

| Approved salary expense level | 119,704 | 125,133 | 5,429(c) |

| Agreed borrowing limit | - | - | (d) |

(1) As specified in the Budgets Statements.

(2) Further explanations are contained in Note 9.12 ‘Explanatory statements’ to the financial statements.

a) The variation in Net Cost of Services is mainly due to lower than anticipated receipt of Commonwealth Grants for major capital works, as a result of changed project milestones.

b) The variation in Total Equity is mainly due to the revaluation of Infrastructure Road Assets undertaken as at 30 June 2018 using construction unit rates obtained from professional quantity surveying firms which represent the fair value to replace the assets, and applying these against the units for each infrastructure category. For 2017-18, the Road and Bridges Construction Cost Index movement of 1.8% was applied.

c) The increase in salary expense is predominantly due to redundancy payments made as a result of the Voluntary Targeted Separation Scheme.

d) Main Roads did not borrow any funds during the 2017-18 financial year.

| 2017-18 Agreed Limit $000 |

2017-18 Target (1)/ Actual (2) $000 |

Variation (3) $000 |

|

| Agreed Working Cash Limit (at Budget) | 42,118 | 42,118 | N/A |

| Agreed Working Cash Limit (at Actuals) | 42,118 | 42,133 | 15 |

(1) Target to reflect the agency’s anticipated working cash for the relevant financial year.

(2) Actual to reflect the actual working cash held at the close of the financial year.

(3) Below agreed limit during the financial year.

Reporting to the Department of Treasury

We provide monthly, quarterly and annual financial statement information to the Department of Treasury, which is subject to external audit by the Office of the Auditor General. This is an independent check on the integrity of our financial reporting. We are also required to report annually against achievement of financial targets and financial measures in the Resource Agreement between the Commissioner of Main Roads, Managing Director of Main Roads, Minister for Transport and the Treasurer.

Management Reporting

Both Financial Reports and Program Management Reports are tabled monthly and quarterly at Corporate Executive. These report on projects and progress against key performance indicators. In addition, regions and branches conduct monthly finance reviews, with reports presented at Directorate Management meetings.

Accounting and Financial Management Policies

A comprehensive Financial Management Manual containing accounting and financial management policies and procedures is maintained together with Control Self- Assessment Checklists. These documents communicate accountability for procedures within responsibility areas and enhance the level of internal control. The Manual and Checklists enable management as well as internal and external auditors to monitor compliance with established policies and procedures and, together with the Financial Management Act 2006 (WA) and the Treasurer’s Instructions, are available online to all employees.

Capital Works

All disclosures in relation to capital works are included in the Financial Statements and Notes. Our annual Strategic Asset Plan details our 10-year investment needs and drivers. The Strategic Asset Plan adheres to the Department of Treasury’s Strategic Asset Management Framework. We assess projects for funding by submitting comprehensive business cases to the Road Planning Investment Committee and Corporate Executive, and according to their (direct and in-direct) economic, environmental and social impacts. Each capital project follows the national Austroads project evaluation methodology where a Benefit Cost Ratio (BCR) must be conducted and calculated. This incorporates quantifiable economic data and is supplemented by simplified economic, environmental and social assessments. The BCR records information on the benefits of a project on travel time savings, vehicle operating costs and smoother travel, safety, and maintenance. Other benefits and costs are considered via a multi-criteria analysis. Our approved priority Capital projects are then submitted to the Department of Transport’s Portfolio Investment Steering Committee for rating and assessment against all Transport

Portfolio priorities, with shortlisted priorities submitted to the Minister for Transport for approval as part of the Department of Treasury’s Annual Budget Cycle. Capital works financial progress is reported to the Corporate Executive on a monthly basis and to the Department of Transport’s Transport Portfolio Investment Coordination Branch on a quarterly basis. Main Roads has a Business Case Guidelines document which details the minimum requirements and outlines the preferred template for a business case. Both State and Commonwealth templates have a section on alignment to State Priorities, Government Goals and Main Roads outcomes. The Infrastructure Australia template has a section on alignment to Government goals and other strategies. Indirect economic benefits (those that are outside the scope of the usual Benefit Cost Assessment) are now being measured through wider economic benefits – these are an attempt to monetarise the benefits a project delivers to the wider economy through enabling infrastructure. Main Roads has adopted a post project evaluation framework to measure project success – to ensure we are achieving the intended KPI’s and outcomes from project investment. This Benefit Realisation Framework is endorsed by Australian Transport Assessment and Planning and is a key feature of ISCA’s Rating Tool, V2.0.

Sustainable Procurement and Buy Local

The State Supply Commission Policy on sustainable procurement requires us to demonstrate that we have considered sustainability in our procurement of goods and services. We have gone beyond the requirements of this policy to reflect this in not only our processes for procuring goods and services but also in procuring works. We apply the Western Australian Government’s Buy Local Policy where we consider and give preference to local providers in our purchases as the benefits to industry development and employment are recognised. Buy Local Policy clauses are also included in all our tender documents and tender assessments. In addition we promote social procurement initiatives such as: direct purchasing from Aboriginal Businesses; using WA Disability Enterprises to provide works, goods and services; and giving recognition to our contractors who employ Aboriginal people and businesses.

In 2018 we introduced contractual requirements for Contractors to employ Aboriginal People and subcontract to Aboriginal Businesses. This includes mandating minimum employment and subcontracting percentages that must be met in the delivery of works. Reporting for Buy Local is extracted from information contained within the Department of Finance’s Tenders WA website. Data is not yet available for the current year.

Awarded to businesses located within the ‘prescribed distance’ of a regional delivery point as defined in the Buy Local Policy

| 2014 (%) | 2015 (%) | 2016 (%) | 2017 (%) | ||||

| Metro | Regional | Metro | Regional | Metro | Regional | Metro | Regional |

| N/A | 57 | N/A | 51 | N/A | 52 | N/A | 61 |

| Awarded to a ‘local business’ as defined in the Buy Local Policy (Target 80%) | |||||||

| Metro | Regional | Metro | Regional | Metro | Regional | Metro | Regional |

| 99 | 91 | 91 | 88 | 91 | 96 | 98 | 92 |

Ethical Procurement

Our procurement policies and procedures comply with the requirements of the State Supply Commission and are certified to AS/NZS 9001:2015. These policies are contained in the Procurement Management Manual, with further guidelines of expected behaviours of officers involved in the tendering and evaluation process documented in the Tendering and Contract Administration Manual. An ongoing compliance program is in place to ensure these policies and procedures are implemented. Conflict of interest and misconduct awareness training sessions are ongoing.

A Tender Committee, consisting of two experienced senior officers from our organisation and two senior external Government officials, provides additional assurance that procurement actions comply with policies and standards for high risk and potentially contentious procurements. External probity auditors are engaged for large, complex or controversial procurements activities.

Procurement Grievances

Our procedure for dealing with procurement grievances is referenced in all tender documents and a copy is accessible from our website. The procedure has been endorsed by the Western Australian Road Construction and Maintenance Industry Advisory Group and provides for a customer-focused, fair and structured, and relationship-based approach to reviewing grievances lodged by contractors. During 2017-18 one grievance was received, reviewed and subsequently closed out. There has been an average of one grievance per year over the past five years, confirming our procurement processes continue to be fair and equitable.

Significant Contractors

The table below lists our major suppliers and contractors and their award value over the past year.

| Major Suppliers/Contractors | 2018 Award Value $million (GST excl) |

| SRG Civil Pty Ltd | 5.0 |

| AECOM Australia Pty Ltd | 5.5 |

| Rubicor Gov Pty Ltd | 7.8 |

| Coleman Rail Pty Ltd | 8.4 |

| BG&E Pty Limited | 8.4 |

| GHD and BG&E Joint Venture | 9.0 |

| WA Stabilising | 9.3 |

| GHD Pty Ltd | 9.3 |

| Supercivil Pty Ltd | 9.9 |

|

Densford Civil Pty Ltd / Marine & Civil Pty Ltd Joint Venture |

10.1 |

| Fulton Hogan Industries Pty Ltd | 10.1 |

| Downer EDI Works Pty Ltd | 10.8 |

|

BMD Constructions Pty Ltd (QLD) |

16.1 |

| Georgiou Group Pty Ltd | 18.7 |

| Colas Western Australia Pty Ltd | 20.3 |

| CPB Contractors Pty Ltd | 21.8 |

|

Watpac Civil & Mining Pty Ltd (Perth) |

22.0 |

| Intersectional Linemarkers Pty Ltd | 22.1 |

|

Highway Construction/Albem Operations Joint Venture |

25.1 |

|

Margaret River Perimeter Road Joint Venture |

27.0 |

| MACA Civil Pty Ltd | 30.2 |

|

WBHO Infrastructure Australia Pty Ltd (Perth) |

48.2 |

| DM Roads | 90.4 |

| Ventia Pty Limited | 95.2 |

| BMD Constructions Pty Ltd (WA) | 101.1 |

| Lend Lease Services Pty Ltd | 181.1 |

Unauthorised Use of Credit Cards

We hold 461 corporate credit cards with transactions reviewed for personal use by incurring and certifying officers during statement processing.

During the financial year there were 38,444 credit card transactions, 11 of which were found to be for personal expenditure totalling $377.32. All of which has been reimbursed.

- Nine transactions were accidental use of the corporate card instead of a personal card

- Two transactions were the result of the EFTPOS machine picking up the wrong card where both personal and corporate cards were in close proximity.

Due to the nature of the personal expenditure in each instance, no disciplinary action was deemed to be required.

Pricing Policies of Services Provided

Our supply of goods and services represent works and services carried out for other public sector and private bodies on a cost recovery basis. Details are available in the notes to the Financial Statements. Relevant Pricing Policies we set are developed in accordance with the Department of Treasury’s Costing and Pricing Government Services Guidelines.

Government Building Training Policy

State Government Building and Construction Contracts

| Measure | Number |

| Active contracts within the scope of the GBT Policy in the reporting period | 8 |

| Contracts granted a variation to the target training rate in the reporting period | 0 |

| Head contractors involved in the contracts | 11 |

| Construction apprentices/trainees required to meet target training rate across all contracts | 356 |

| Construction apprentices/trainees employed by head contractors and the subcontractors they are using for the contracts | 298 |

| Contracts which met or exceed the target training rate | 1 |

Statement of Expenditure Required Under Section 175ZE of The Electoral Act 1907

In accordance with Section 175ZE of the Electoral Act 1907, Main Roads Western Australia incurred $366,300.00 during 2017-18 in advertising, market research, polling, direct mail and media advertising. Expenditure was incurred in the following areas:

| Advertising Agencies | $ |

| 303 MullenLowe Australia Pty Ltd | 9,800 |

| Adcorp Australia Ltd | 17,200 |

| Angry Chicken Publishing Pty Ltd | 10,800 |

| Anthologie | 6,200 |

| Clockwork Print | 5,300 |

| Cooch Creative Pty Ltd | 2,500 |

| Daniels Printing Craftsmen | 13,600 |

| Farm Guide Pty Ltd | 5,100 |

| Icon Illustration | 1,600 |

| Jiffy Instant Print | 200 |

| Advertising Agencies Total | 172,300 |

| Direct Mail Organisations | $ |

| Daniels Printing Craftsmen | 24,000 |

| Quickmail | 1,600 |

| The Pamphleteer | 7,100 |

| Direct Mail Organisations Total | 32,700 |

| Market Research Organisations | $ |

| 303 MullenLowe Australia Pty Ltd | 200 |

| Metrix Consulting Pty Ltd | 139,800 |

| Surveymonkey | 300 |

| Market Research Organisations Total |

140,300 |

| Polling Organisations | $ |

| nil | |

| Media Advertising Organisations | $ |

| Adcorp Australia Ltd | 7,700 |

| Carat Australia Media Services Pty Ltd |

3,500 |

| 4,700 | |

| Imagesource Digital Solutions | 800 |

| Onpress Digital Pty Ltd | 100 |

| Quickmail | 700 |

| West Australian Newspaper | 3,500 |

| Media Advertising Organisations Total |

21,000 |

| Grand Total | 366,300 |

Corporate Business Plan 2017–2021

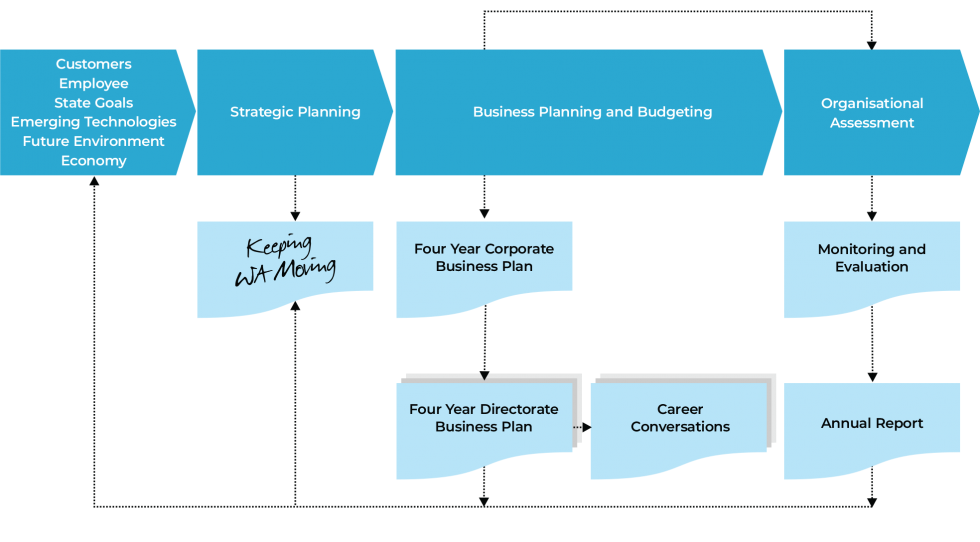

Our Corporate Business Plan specifically identifies priorities, actions, targets and measures that must be considered as part of the development of Directorate and Branch Business Plans. Our integrated approach to planning is based on input from partners, stakeholders, customers and employees. The input is coordinated through our Strategic Plan, the Corporate Business Plan, Directorate and Branch Business Plans and ultimately all employees through Career Conversations, as shown in the chart. Our Corporate Business Plan aligns with our strategic direction and government goals and objectives. Our Corporate Business Plan is the basis for all Directorate and Branch Business Plans and ensures planning, delivery, maintenance and operational activities are aligned with our corporate direction.

We review our progress monthly, quarterly, biannually and annually. Reporting varies from online scorecards and dashboard style information, through to staff communiques from Corporate Executive.