Additional Disclosures

Additional Financial Disclosures

Financial Targets: Actuals Compared to Budget

The following table provides a comparison of the financial targets and outcomes against criteria included in the Resource Agreement between the Commissioner of Main Roads, Minister for Transport and the Treasurer.

|

2019 – 20 |

2019 – 20 |

Variation 2 |

|

|

Total cost of services |

1,489,935 |

1,242,505 |

(247,430) a |

|

Net cost of services |

518,748 |

295,832 |

(222,916) b |

|

Total equity |

50,218,148 |

49,172,517 |

(1,045,631) c |

|

Salary expense limit |

58,429 |

59,461 |

1,032 d |

|

Borrowing limit |

– |

– |

– e |

1. As specified in the Budgets Statements.

2. Further explanations are contained in Note 9.13 ‘Explanatory statements (Controlled Operations)’ to the financial statements.

a) The variation in Total Cost of Services is mainly due to:

– Supplies and services underspent by $216.9 million (32.7%) as a result of $112 million more capitalised than anticipated. This amount is reported under infrastructure and fixed asset within the balance sheet. Moreover, the underspend on Local Roads and WANDRRA reimbursements (e.g. WANDRRA, Outback Way and Tanami Road) is also a major reason for payments being lower than the budget.

b) The variation in Net Cost of Services is mainly due to:

– Services and supplies was lower than anticipated by $216.9 million.

c) The variation in Total Equity is mainly due to:

– The Infrastructure Asset value was overestimated by $766m (2.3%) and the Land value was overestimated by $1,185m (5.2%) compared with the Original Target, which was offset by the underestimate of $778m in the Work In Progress infrastructure assets value.

d) The variation in Salary Expense is mainly due to:

– a lower than estimated clearance of leave as a result of an increased Priority Projects Works Program.

e) Main Roads did not borrow any funds during the 2019-20 financial year.

|

2019 – 20 Agreed Limit 1 |

2019 – 20 |

Variation 2 |

|

|

Agreed Working Cash Limit |

49,894 |

36,749 |

(13,145) f |

f) The variation in Working Cash Limit was a result of a significant decreased recurrent operating payment requirement.

Reporting to the Department of Treasury

We provide monthly, quarterly and annual financial statement information to the Department of Treasury, which is subject to external audit by the Office of the Auditor General. This is an independent check on the integrity of our financial reporting. We are also required to report annually against achievement of financial targets and financial measures in the Resource Agreement between the Commissioner of Main Roads, Managing Director of Main Roads, Minister for Transport and the Treasurer.

Management Reporting

Both Financial Reports and Program Management Reports are tabled monthly and quarterly at Corporate Executive. These report on projects and progress against key performance indicators. In addition, regions and branches conduct monthly finance reviews, with reports presented at Directorate Management meetings.

Accounting and Financial Management Policies

A comprehensive Financial Management Manual containing accounting and financial management policies and procedures is maintained together with Control Self-Assessment Checklists. These documents communicate accountability for procedures within responsibility areas and enhance the level of internal control. The Manual and Checklists enable management as well as internal and external auditors to monitor compliance with established policies and procedures and, together with the Financial Management Act 2006 (WA) and the Treasurer’s Instructions, are available online to all employees.

Capital Works

All disclosures in relation to capital works are included in the Financial Statements and Notes. Our annual Strategic Asset Plan details our 10-year investment needs and drivers. The Strategic Asset Plan adheres to the Department of Treasury’s Strategic Asset Management Framework. We assess major capital projects for funding by submitting comprehensive business cases to the Investment Planning Committee and Main Roads Investment Executive, and according to their direct and in-direct economic, environmental and social impacts. Each major capital project follows the national Austroads project evaluation methodology where a Benefit Cost Ratio (BCR) is conducted and calculated. This incorporates quantifiable economic data and is supplemented by simplified economic, environmental and social assessments.

The BCR records information on the benefits of a project on travel time savings, vehicle operating costs and smoother travel, safety, and maintenance. Other benefits and costs are considered via a multi-criteria analysis. Our approved priority capital projects are then submitted to the Transport Portfolio Investment Sub Committee for endorsement of rating and assessment against all Transport Portfolio priorities, with shortlisted priorities submitted to the Minister for Transport for approval as part of the Department of Treasury’s Annual Budget Cycle. Capital works financial progress is reported to the Corporate Executive on a monthly basis.

Main Roads has a Business Case Guidelines document which details the minimum requirements and outlines the preferred template for a business case. Both State and Commonwealth templates have a section on alignment to State Priorities, Government Goals and Main Roads outcomes. The Infrastructure Australia template has a section on alignment to Government goals and other strategies. Indirect economic benefits (those that are outside the scope of the usual Benefit Cost Assessment) are now being measured through wider economic benefits in an attempt to monetarise the benefits a project delivers to the wider economy through enabling infrastructure.

Main Roads has adopted a post project evaluation framework to measure project success – to ensure we are achieving the intended KPI’s and outcomes from project investment. This Benefit Realisation Framework is endorsed by Australian Transport Assessment and Planning and is a key feature of ISCA’s Rating Tool, V2.0.

Sustainable Procurement, Buy Local and WA Industry Participation Strategy

The State Supply Commission policy on sustainable procurement requires us to demonstrate that we have considered sustainability in our procurement of goods and services. We have gone beyond the requirements of this policy to reflect this in not only our processes for procuring goods and services but also in procuring works.

Main Roads applies the Infrastructure Sustainability Council of Australia’s Industry Sustainability rating tool on our major design and construct and alliance contracts.

We apply the Western Australian Government’s Buy Local Policy in the evaluation of tenders and stated commitments are included in the awarded contract that obligates the successful contractor to report on Buy Local commitments when submitting each monthly progress claim. WAIPS applies to all our contracts that meet the value thresholds. Tenderers are required to submit local participation plans as part of their tender to detail employment and local subcontracting opportunities that will arise if awarded the contract.

In addition, we promote social procurement initiatives such as direct purchasing from Aboriginal businesses and Western Australian disability enterprises. We exceeded the targets set by the State Aboriginal Procurement Policy, with Aboriginal procurement, employment and training targets mandated in all our major infrastructure and maintenance contracts.

Ethical Procurement

Our procurement policies and procedures comply with the requirements of the State Supply Commission and are certified to ISO 9001:2015. These policies are contained in the Procurement Management Manual. Further guidelines of expected behaviours of officers involved in the tendering and evaluation process is documented in the Tendering and Contract Administration Manual and Integrity Framework. An ongoing compliance program is in place to ensure these policies and procedures are adhered to.

A Tender Committee, consisting of two experienced senior officers from our organisation and two senior external government officials, provides additional assurance that procurement actions comply with policies and standards for high-risk and potentially contentious procurements. External probity auditors are engaged for large, complex or controversial procurement activities.

Procurement Grievances

Our procedure for dealing with procurement grievances is referenced in all tender documents and is accessible from our website. The procedure is endorsed by the Western Australian Road Construction and Maintenance Industry Advisory Group and provides for a customer-focused, fair, structured and relationship-based approach to reviewing grievances lodged by contractors. During the year, no grievances were received. This is the second year where no grievances were received, confirming our procurement processes continue to be fair and equitable.

Significant Contractors

The table below lists suppliers awarded contracts during 2019–20 with a combined estimated value of $10 million or more.

| Trading Name |

|

AECOM Australia Pty Ltd & Aurecon Australasia Pty Ltd |

|

Arup Pty Ltd |

|

ASG Group Limited |

|

BG&E Pty Limited |

|

BMD Constructions Pty Ltd (WA) |

|

Central Earthmoving |

|

Clough Projects Australia Pty Ltd & Coleman Rail Pty Ltd |

|

Georgiou Group Pty Ltd |

|

GHD Pty Ltd |

|

Jacobs Group (Australia) Pty Ltd |

|

Kellogg Brown & Root Pty Ltd (Pth) |

|

LendLease Services Pty Limited |

|

MACA Civil Pty Ltd |

|

Tonkin Gap Alliance – Georgiou Group Pty Ltd, BMD Constructions Pty Ltd, WA Limestone Contracting Pty Ltd, GHD Pty Ltd, BG&E Pty Limited |

|

Wongutha Way Alliance (Carey MC and Central Earthmoving) |

|

WSP Australia Pty Limited |

Unauthorised Use of Credit Cards

We hold 539 corporate credit cards with transactions reviewed for personal use by incurring and certifying officers during statement processing.

During the financial year there were 39,571 credit card transactions totalling $31,720,713.90, of which 29 transactions totalling $964.65 were found to be for personal expenditure.

- All transactions were accidental use of the corporate card instead of a personal card.

- Eleven transactions were the result of the accidental swap of a personal credit card with a corporate card meaning repeat transactions were not detected until the end of the month.

Due to the nature of the personal expenditure in each instance, no disciplinary action was deemed to be required.

Pricing Policies of Services Provided

Our supply of goods and services represents works and services carried out for other public sector and private bodies on a cost recovery basis. Details are available in the notes to the Financial Statements. Relevant pricing policies we set are developed in accordance with the Department of Treasury’s Costing and Pricing Government Services Guidelines.

Government Building Training Policy

State Government Building and Construction Contracts

| Measure | Number |

|

Active contracts within the scope of the GBT Policy in the reporting period |

14 |

|

Contracts granted a variation to the target training rate in the reporting period |

0 |

|

Head contractors involved in the contracts |

16 |

|

Construction apprentices/trainees required to meet target training rate across all contracts |

812 |

|

Construction apprentices/trainees employed by head contractors and the subcontractors they are using for the contracts |

815 |

|

Contracts which met or exceed the target training rate |

7 |

Statement of Expenditure

In accordance with Section 175ZE of the Electoral Act 1907, Main Roads incurred expenses of $361,500 during 2019–20 in advertising, market research, polling, direct mail and media advertising. Expenditure was incurred in the following areas:

| $ | |

|

ADVERTISING AGENCIES |

|

|

Initiative Media Australia Pty Ltd |

35,800 |

|

Mitchell Communication |

1,500 |

|

Advertising Agencies Total |

37,300 |

|

DIRECT MAIL ORGANISATIONS |

|

|

Daniels Printing Craftsmen |

12,400 |

|

Quickmail |

1,200 |

|

The Pamphleteer |

9,600 |

|

Direct Mail Organisations Total |

23,200 |

|

MARKET RESEARCH ORGANISATIONS |

|

|

Metrix Consulting Pty Ltd |

171,200 |

|

Painted Dog Research Pty Ltd |

18,200 |

|

Market Research Organisations Total |

189,400 |

|

POLLING ORGANISATIONS |

Nil |

|

MEDIA ADVERTISING ORGANISATIONS |

|

|

Acm Rural Pres |

100 |

|

Business News Pty Ltd |

1,400 |

|

Carat Australia Media Services Pty Ltd |

64,600 |

|

Clockwork Print |

1,700 |

|

|

4,400 |

|

Farm Guide Pty Ltd |

5,100 |

|

Hits Radio Pty Ltd |

300 |

|

Imagesource Digital Solutions |

13,900 |

|

Media Group |

900 |

|

Snap East Perth |

1,400 |

|

Success Print |

300 |

|

West Australian Newspaper |

17,500 |

|

Media Advertising Organisations Total |

111,600 |

|

Grand Total |

361,500 |

Additional Environmental and Sustainability Disclosures

Infrastructure Sustainability Rating Status

We use the Infrastructure Sustainability (IS) Rating Scheme to evaluate sustainability within our highest value major projects. We have mandated that all projects greater than $100 million will be formally registered to undergo an IS rating. The table below indicates the status of our registered ratings across the project phases of planning, development, design and construction.

| Program | Project | IS Version | Current Rating Phase | Target Rating | Tracking Status |

|

Great Northern Highway Muchea to Wubin Stage 2 Upgrade |

Overall Program |

1.2 |

A Built |

Commended |

Verified Excellent Design |

|

Muchea North |

1.2 |

As Built |

Commended |

Verified Excellent Design |

|

|

New Norcia Bypass |

1.2 |

As Built |

Commended |

Verified Excellent Design |

|

|

Walebing |

1.2 |

As Built |

Commended |

Scoped Out for As Built |

|

|

Miling Bypass |

1.2 |

As Built |

Commended |

Verified Excellent Design |

|

|

Miling Straight |

1.2 |

As Built |

Commended |

Verified Excellent Design |

|

|

Pithara |

1.2 |

As Built |

Commended |

Verified Excellent Design |

|

|

Wubin |

1.2 |

As Built |

Commended |

Scoped Out for As Built |

|

|

NorthLink WA |

NorthLink WA Central Section |

1.2 |

Complete |

Excellent |

Verified Excellent As Built |

|

NorthLink WA Northern Section |

1.2 |

Design |

Excellent |

Excellent |

|

|

Metropolitan Roads Improvement Alliance |

Armadale Road |

1.2 |

As Built |

Excellent |

Verified Excellent Design |

|

Murdoch Activity Centre |

1.2 |

As Built |

Excellent |

Verified Excellent Design |

|

|

Wanneroo Road Duplication |

1.2 |

As Built |

Excellent |

Verified Excellent Design |

|

|

Armadale Road |

Armadale Road Northlake Road Bridge |

2 |

Design |

Silver |

Silver |

|

Bunbury Outer Ring Road |

Bunbury Outer Ring Road |

2 |

Planning |

Bronze |

Verified Silver Rating |

|

Mitchell Freeway |

Mitchell Freeway Extension – Hester Romeo |

2 |

Planning |

Bronze |

Bronze |

|

Tonkin Highway |

Tonkin Gap and Associated Works |

2 |

Planning |

Bronze |

Bronze |

|

Tonkin Highway |

Tonkin Highway Extension |

2 |

Planning |

Bronze |

Bronze |

|

Swan River crossings |

Swan River crossings |

2 |

Planning |

Bronze |

Bronze |

|

Albany Ring Road |

Albany Ring Road |

2 |

Planning |

Bronze |

Bronze |

|

Tonkin Highway |

Tonkin Grade Separations |

2 |

Planning |

Bronze |

Bronze |

|

Great Eastern Highway |

GEH Bypass |

2 |

Planning |

Bronze |

Bronze |

|

Karratha-Tom Price |

Karratha-Tom Price |

2 |

Planning |

Bronze |

Bronze |

|

East Link |

East Link |

2 |

Planning |

Bronze |

Bronze |

Emissions by Type due to Operations and Congestion

As part of a commitment to develop a data driven approach to addressing congestion, based around agreed performance metrics and targets, a cloud based data factory was developed to collate and report road network performance data across major roads in metropolitan Perth.

The data system collates speed and volume information from multiple data sources across the 4,300 links, which currently represent the Perth major road network. Data is recorded on each link for every 15-minute interval dating back to January 2013. This data system has been named the Network Performance Reporting System or ‘NetPReS’. Using the Australian Transport Assessment and Planning Guidelines 2016 published by the Transport and Infrastructure Council, NetPReS data has been used to estimate emissions trends on state roads and significant local roads in the Perth metropolitan area.

Main Roads takes action to directly manage the traffic flow of vehicles, which has consequences for the overall environmental impacts from the use of the road network that includes carbon emissions and air quality. The following tables reflect the impact that the roads we directly manage are having on energy use and emissions, which give an indication of the impact to air quality.

|

Annual Emissions due to Operations Estimates for Perth Metropolitan State Road Network and Significant Local Roads |

|||

|

2018 |

2019 |

2020 |

|

|

MVKT |

10,607 |

10,477 |

9,644 |

|

Fuel Consumed (kl) |

1,411,000 |

1,399,000 |

1,285,000 |

|

Emissions by Type (tonnes per year) |

|||

|

CO2 |

3,267,000 |

3,239,000 |

2,975,000 |

|

CH4 |

427 |

423 |

389 |

|

N2O |

99 |

98 |

90 |

|

NOX |

1,712 |

1,697 |

1,559 |

|

CO |

12,294 |

12,190 |

11,196 |

|

NMVOC |

4,266 |

4,230 |

3,885 |

|

SOX |

224 |

222 |

204 |

|

PM10 |

40 |

39 |

36 |

|

Annual Emissions due to Congestion Estimates for Perth Metropolitan State Road Network and Significant Local Roads |

|||

|

2018 |

2019 |

2020 |

|

|

Fuel Consumed (kl) |

57,000 |

53,000 |

50,000 |

|

Emissions by Type (tonnes per year) |

|||

|

CO2 |

132,000 |

123,000 |

116,000 |

|

CH4 |

17 |

16 |

15 |

|

N2O |

4 |

4 |

4 |

|

NOX |

69 |

64 |

61 |

|

CO |

497 |

462 |

436 |

|

NMVOC |

172 |

160 |

151 |

|

SOX |

9 |

8 |

8 |

|

PM10 |

2 |

1 |

1 |

Emissions Metrics

|

Scope 1 or 2 and 3 |

|||

|

GHG Type (t CO2) |

2018 |

2019 |

2020 |

|

Fuel |

3,088 |

3,374 |

3,412 |

|

Street and traffic lights |

18,614 |

22,382 |

20,236 |

|

Buildings |

4,183 |

4,123 |

4,152 |

|

Air travel* |

331 |

527 |

180 |

|

Projects and maintenance fuel use* |

27,661 |

40,686 |

20,670 |

|

Waste* |

10,241 |

19,317 |

6,739 |

|

Offsets |

0 |

-2,749 |

-3,008 |

|

Total |

53,877 |

87,660 |

52,381 |

* Note: Air travel, project and maintenance fuel usage and waste are Scope 3 emissions

|

Scope 1 or 2 and 3 |

|||

|

GHG Category |

2018 |

2019 |

2020 |

|

Scope 1 |

3,296 |

3,347 |

3,375 |

|

Scope 2 |

22,590 |

24,578 |

22,882 |

|

Sub Total |

25,886 |

27,925 |

26,257 |

|

Offsets |

0 |

-2,749 |

-3,008 |

|

Total |

25,886 |

25,176 |

23,249 |

|

Scope 3 |

38,232 |

62,483 |

29,132 |

|

Energy Use by Source |

|||

|

Energy Source |

2018 |

2019 |

2020 |

|

Electricity usage (MJ) (within) |

116,622,673 |

128,476,842 |

123,072,434 |

|

Installed Renewable Energy (MJ) (within) |

_ |

1,800,180 |

3,202,232 |

|

Fuel and gas usage (MJ) (within) |

47,353,145 |

49,387,873 |

49,182,637 |

|

Projects and maintenance (outside) |

374,828,266 |

548,731,936 |

277,381,557 |

|

Intensity Indicators |

|||

|

2018 |

2019 |

2020 |

|

|

MJ per km State Road |

8,850 |

9,876 |

9,249 |

|

Scope 1 and 2 t CO2 |

1.40 |

1.50 |

1.41 |

Imported Road Construction Materials

|

Indicator |

2018 (000) |

2019 (000) |

2020 (000) |

|

Sand (t) |

5,722.9 |

2,678.0 |

175.7 |

|

Gravel (t) |

1236.7 |

2,037.9 |

2408.5 |

|

Crushed rock (t) |

684.5 |

825.7 |

895.0 |

|

Limestone (t) |

814.4 |

520.9 |

148.3 |

|

Aggregate (t) |

172.6 |

45.2 |

70.6 |

|

Asphalt (t) |

403.9 |

422.7 |

250.7 |

|

Bitumen |

1284.4 |

40.8 |

2563.8 |

|

Bitumen cutter |

223.0 |

36.6 |

653.4 |

|

Emulsion |

789.2 |

27.0 |

1775.0 |

|

Concrete and steel (t) |

152.2 |

56.0 |

44.1 |

|

Concrete |

– |

32.0 |

34.3 |

|

Cement stabilised backfill |

– |

12.0 |

33.2 |

|

Mulch |

– |

12.0 |

2.4 |

|

Other (steel, paint, glass, primer, topsoil) (t) |

67.5 |

19.0 |

13.1 |

Imported Recycled Construction Materials

|

Indicator |

2018 (000) |

2019 (000) |

2020 (000) |

|

Sand (t) |

0.0 |

99.6 |

13.9 |

|

Road base (t) |

33.9 |

66.3 |

57.2 |

|

Asphalt / profiling (t) |

2.1 |

14.4 |

13.4 |

|

Crushed glass (t) |

17.1 |

7.4 |

56.0 |

|

Rehabilitation purposes (t) – unsuitable material |

7.0 |

88.5 |

4.3 |

|

Other (crumbed rubber, limestone, plastic, concrete, steel, topsoil, mulch) (t) |

0.6 |

0.8 |

13.6 |

|

Imported construction materials with an eco |

6.0 |

1.5 |

1.5 |

Waste Materials to Landfill (Waste)

| Indicator | 2018 (000) |

2019 (000) |

2020 (000) |

|

Kerbing / concrete (t) |

0.02 |

2.4 |

3.1 |

|

Existing seal (t) |

3.0 |

2.5 |

1.2 |

|

Unsuitable material (t) |

39.0 |

77.0 |

27.0 |

|

Site office / general waste |

0.04 |

2.2 |

0.6 |

|

Contaminated material |

-1.2 |

77.6 |

77.6 |

|

Other (roadside litter / waste, plastics) (t) |

0.1 |

0.02 |

1.9 |

Materials Recycled

| Indicator | 2018 (000) |

2019 (000) |

2020 (000) |

|

Sand (t) |

73.7 |

162.2 |

118.3 |

|

Road base (t) |

3.6 |

46.8 |

5.2 |

|

Asphalt / profiling (t) |

24.8 |

17.0 |

2.2 |

|

Steel (t) |

0.6 |

0.2 |

0.8 |

|

Concrete (t) |

0.3 |

12.6 |

12.7 |

|

Office waste, general, roadside litter (t) |

1.6 |

0.7 |

7.7 |

|

Timber |

0.2 |

0.9 |

0.6 |

|

Rock |

– |

89.4 |

0.3 |

|

Other (green waste, plastic, topsoil, hydrocarbons) (t) |

0.0 |

0.5 |

3.6 |

Data is based on calendar year

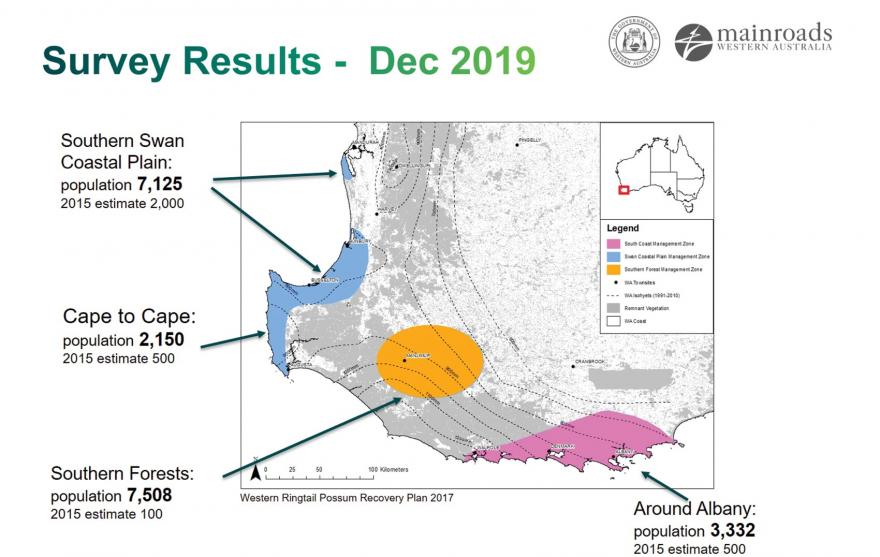

Western Ringtail Possum Regional Surveys Project Map

Stakeholder Map – Stakeholder Inclusiveness

As an organisation there are two broad categories of stakeholders with which we engage and our method to stakeholder engagement varies accordingly.

Project Stakeholders are a person, business, organisation or group, interested in or impacted by a project or initiative we are undertaking. Initial identification occurs during the Planning stages of a project and new stakeholders are identified through the project lifecyle based on their interest / impact. Project Stakeholders can vary from project to project and are tracked and managed in our Customer Relationship Management System (CONNECT).

Corporate Stakeholders are a person, business, organisation or group interested in or impacted by our agency who may partner with us and influence or hamper the work we do. Corporate stakeholders are identified using an annual process that involves internal stakeholders across the entire organisation.

Timing of the process aligns with Main Roads business planning cycle, to ensure that stakeholder engagement is a key enabler of business plans at all levels. The common groups engaged by our organisation include:

Investors

- State Treasury

- Federal Funding Agencies

Employees

- Full time, part time

- Contract

Road Customers

- General Travelling Public

- Commuters

- Workers

- Heavy Vehicle, Freight and Logistics

- Public Transport

- Interfacing landholders

- Schools

- Network and Event Management

Suppliers and Contractors

Government agencies

Non-governmental Organisations

Regulators and Bodies

- Department of Water and Environmental Regulation

- Department of Planning, Lands and Heritage (Aboriginal Affairs)

- Department of Mines, Industry Regulation and Safety (WorkSafe)

- Office of the Federal Safety Commission

- WorkCover WA

- Safe Work Australia

- Insurance Commission of Western Australia (RiskCover)

- Public Sector Commission

Members of Local, State and Federal Government

Lobbyists

- Local resident organisations

- Industry, business and associations

Media

Research and Innovation

- Universities

- Research centres

Unions

Our Approach to Stakeholder Engagement

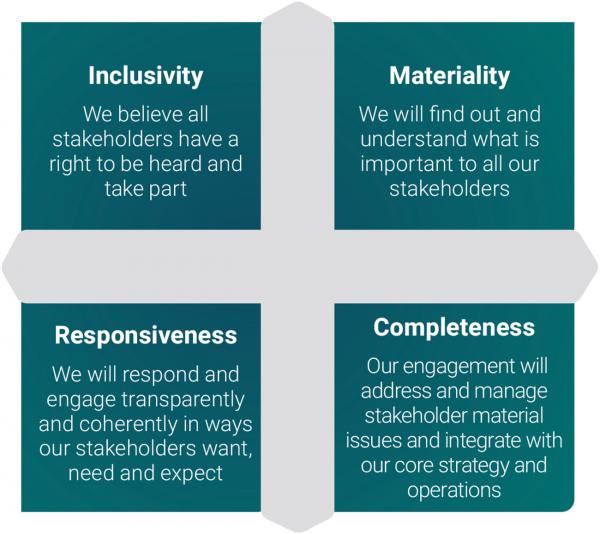

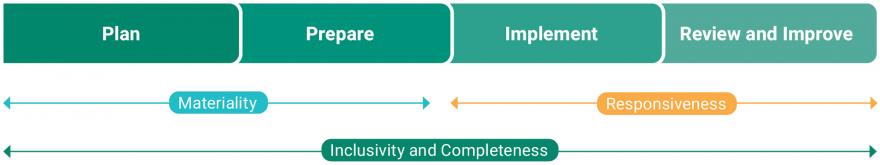

We have adopted the AA1000 Stakeholder Engagement Standard 2015 (AA1000SES) to help us design, implement and assess quality stakeholder engagement that delivers integrated, sustainable outcomes.

Our engagement principles of Inclusivity, Materiality and Responsiveness are based on AA1000SES. We have also adopted the principle of Completeness to align with our commitment to sustainability, driven by the Global Reporting Initiative (GRI).

The AA1000SES principles underpin our engagement process to ensure we can effectively manage expectations about how feedback and involvement will influence decision-making, whilst considering project, commercial and political realities:

Frequency of engagement with each project stakeholder group depends on the specific concern and / or method of engagement identified in the Project Communications and Engagement Strategy. Each engagement is tracked and managed through our Customer Relationship Management System. Corporate stakeholder type and frequency of engagement is identified in the annual Corporate Stakeholder Engagement Action Plan and is dependent on the stakeholder concern and priority level.

Project Stakeholder Concerns

Project stakeholder concerns are unique to each project and are identified during stakeholder engagement planning process. These concerns are determined using a desktop approach that interrogates media, ministerial and customer data sources, and usually depend on the risks associated with the project. Responses to topics and concerns are articulated in the project Communication and Engagement Strategy, which differs from project to project.

Corporate Stakeholder Concerns

We determine corporate stakeholder concerns using a biennial materiality review, performed in accordance with the Global Reporting Initiative (GRI). The review draws from our corporate and legislative requirements, key risks, media and ministerial topics and peer reporting practices to determine what is important to our stakeholders.

Refer to the Materiality assessment to view the broad current concerns and how they are being addressed.

Additional Governance Disclosures

Delegation of Authority

Our Delegation of Authority Manual outlines administrative responsibilities for officers and their authority to carry out day-to-day tasks. The Delegation of Authority is in accordance with the amended Main Roads Act 1930 (WA) and the principle of public administration set out in section 7(d) of the Public Sector Management Act 1994. Employees are aware that delegation limits are specified in the Delegation of Authority Manual and that they must not be exceeded.

Ministerial Directives

There were no directives issued by the Minister for Transport under section 19(b) of the Main Roads Act 1930 (WA), as amended, during the year.

Freedom of Information

The Freedom of Information Act 1992 gives the public a general right to apply for access to documents held by government agencies. An information statement in accordance with the requirements of the Freedom of Information (FOI) Act is available on our website. This statement provides a guide on how to apply for access to documents, as well as information about documents that may be available outside of the FOI process. During the year, we received 54 FOI applications. FOI enquiries can be emailed to: foi@mainroads.wa.gov.au.

Fraud and Corruption Prevention

We have detection activities and strategic controls in place to prevent the misappropriation of funds and inappropriate use of public property including a comprehensive Annual Audit Plan, Detection Plan and Fraud and Corruption Risk Management Cycle. Our Integrity Framework clearly sets out the relevant policies and obligations for all employees with respect to preventing, mitigating and reporting instances of fraud and corruption.

Conduct and Ethics

All employees are expected to abide by the Public Sector Code of Ethics, Main Roads’ Code of Conduct and Integrity Framework and our guiding principles and values. When we receive a complaint or a report of alleged inappropriate behaviour or misconduct, management is required to act by undertaking an initial review of the information or complaint.

The outcome of this review determines the most appropriate action, which may include:

- disciplinary action

- grievance resolution

- performance management

- notification to Corruption and Crime Commission or the Public Sector Commission

- improvement actions.

Customer Privacy

Main Roads, as with all Western Australian Government agencies, is not subject to the Privacy Act 1988 (Cwlth) and to date we do not have an equivalent statute. However, where possible, we adhere to the Australian Privacy Principles set out in Schedule 1 of the Privacy Act.

We value the privacy of our customers and comply with the CCTV Usage Policy that outlines appropriate use. Main Roads does not automatically record its CCTV cameras.

We also operate in accordance with the Surveillance Devices Regulations 1999. We use a commercially available off-the-shelf system to collect anonymous traffic data from Bluetooth-enabled devices in passing vehicles using sensors installed at signalised intersections and selected locations on freeways and controlled access highways. This data cannot identify individual vehicles or people. Our approach to privacy is available on our website.

Public Interest Disclosures

We are committed to the aims and objectives of the Public Interest Disclosure Act 2003. We recognise the value and importance of contributions by staff to enhance administrative and management practices and strongly support disclosures made regarding improper conduct. The Public Interest Disclosure Guidelines are available for all staff.

Conflicts of Interest

Our Code of Conduct and Integrity Framework requires all employees to ensure personal, financial and political interests do not conflict with performance or ability to perform in an impartial manner. Where a conflict of interest occurs, it should always be resolved in favour of the public interest rather than personal interest.

We have a confidential Conflict of Interest Register along with a Gifts and Benefits Register maintained by the Manager Legal and Insurance Services.

We consider conflict of interest to include:

- decisions that are biased, as a result of outside activities or private employment

- outside activities resulting in less than satisfactory work performance or causing breaches of standards such as those relating to occupational safety and health

- use of information for private gain when the information was acquired through official employment

- use of government resources for private gain

- use of government time to pursue private interests

- acceptance of gifts or benefits and hospitality

- disclosure of confidential information obtained during the course of duty

- breach of ethics

- favours granted or received for advantage including political, status, relationship, personal or business advantage

- actions jeopardising government and Main Roads’ policies and procedures

- actions placing Main Roads at risk.

Each Corporate Executive member signs a representation memorandum addressed to the Managing Director including a section on personal interests in our contracts. The Chief Finance Officer, Managing Director and Accountable Authority then sign a Management Representation letter to the Auditor General addressing categories including Internal Controls and Risk Management.

Other than usual contracts of employment of service, no senior officers, firms of which senior officers are members or entities in which senior officers have substantial interests, had any interests in existing or proposed contracts with us during the financial year.

To ensure compliance with the Australian Accounting Standard AASB 124, a Related Party Transaction Declaration is signed by all senior officers declaring personal details, controlling interests and transactional details. These records are audited to ensure internal control processes are consistently managed.

Acceptance of Gifts and Benefits

Our Integrity Framework states that Main Roads employees and contract personnel engaged by Main Roads must not:

- be influenced, or perceived to be influenced, by the offer or receipt of gifts or benefits

- engage in actions where a conflict of interest, or perceived conflict, arises in the course of their duty or contract obligations.

Where a Conflict of Interest, whether actual, potential or perceived, has been identified, strict procedures including declaration to the Manager Legal and Insurance Services must be followed.

Integrated Management System

Our Integrated Management System (IMS) brings together our third-party certified systems and processes into a single framework. This system has been certified under the Quality, Environment and Occupational Health and Safety Standards for a number of years and provides:

- consistency in how we plan and manage projects, contracts, supply, environment, and occupational health and safety

- clarification of roles and responsibilities

- alignment of our processes, procedures and policies with our business activities

- a culture of continuous improvement.

During the year we undertook a surveillance audit of our IMS, confirming we continue to comply with the requirements of International and Australian Standards.

|

Current Certification |

|

|

Standard |

Processes |

|

ISO 9001:2015 Quality Management Systems |

Project Management Contract Management Supply Corporate |

|

ISO 14001:2015 Environmental Management Systems |

Environmental |

|

AS/NZS 4801:2001 Occupational Health and Safety Management Systems |

Occupational Health and Safety |

|

ISO 45001:2018 Occupational Health and Safety Management Systems |

Occupational Health and Safety |

|

Australian Government Building and construction WHS Scheme – Federal Safety Commission |

Occupational Health and Safety |